How To Add Money To Bankmobile Vibe

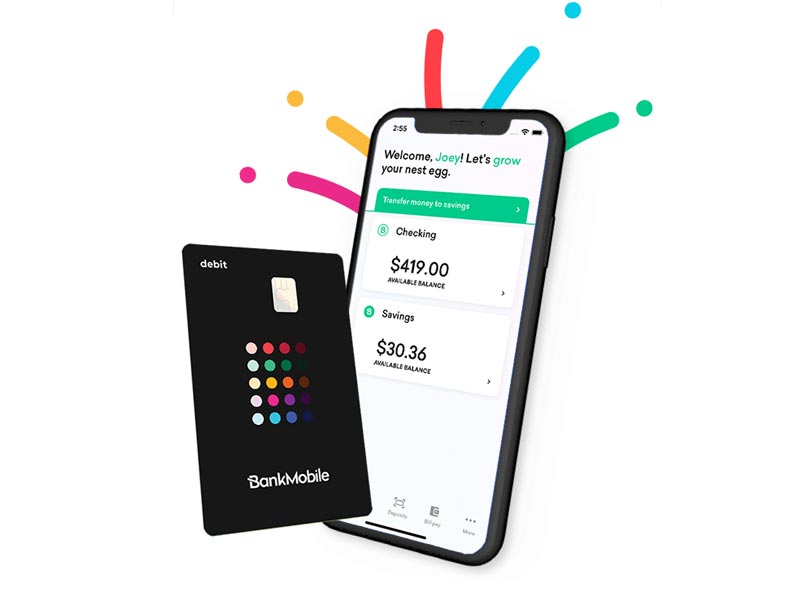

BankMobile is a fiscal company that offers a mobile banking app with branchless banking services and no fees. The company's headquarters is in New York Metropolis. It started its operations in 2015 under the leadership of Jay Sidhu and Luvleen Sidhu. There are diverse transaction activities that you can practice with the company. Today, we shall learn how to transfer coin from the Bankmobile vibe to another banking concern.

Transferring coin from ane establishment to another is very important since it allows money circulation. Businesses tin quickly receive payments from their clients, while employers can pay their workers without much hassle. Transfer of coin tin happen online or at physical branches. Since Bankmobile is an online financial company, transfers accept to occur online or in the mobile app.

We have several ways which you can apply to transfer money from one financial visitor to the other. They include wire transfer, ACH, 3rd parties such as PayPal, Venmo, Payoneer, etc. You can also transfer money using a check. A check is a written certificate that allows financial institutions to get coin from the writer'due south account and requite it to the beneficiary or deposit it into their accounts.

How to open a BankMobile business relationship?

Opening an online bank account is not that difficult since you can do it correct from your phone. You do not accept to walk to a physical branch. You demand to sympathize that Bankmobile is student-oriented, which targets students for their operations. Simply can you transfer money from the Bankmobile vibe to another bank? We will run into the possibility of sending money to other depository financial institution accounts using your BankMobile business relationship.

When it comes to BankMobile, you lot exercise not have to open a BankMobile Vibe account to benefit from its services. You can cull to have your student payroll and fiscal aid disbursement deposited into your electric current checking/savings account.

However, if you are a student who wants a bank business relationship, you lot tin open up a BankMobile account online for convenience. Ordinarily, people open a BankMobile Vibe Checking Account. Once yous open your checking account, yous tin open a savings business relationship. You demand to know that you lot cannot open a savings account earlier opening a checking account.

How to utilise your BankMobile account?

In that location are various transactions that you lot tin can do with your BankMobile account. First of all, you lot can transfer money to someone else'southward depository financial institution account using the routing and business relationship numbers of the receiving business relationship. Also, you can make your purchases online to pay for various services and goods.

As a student, you tin can detect the banking company very helpful since buying goods and other things to support your studies is easy. The company believes that your money should work for y'all and not the other style around.

Therefore, your BankMobile Vibe Up Checking Business relationship allows you to earn up to 0.l% Almanac Percentage Yield (APY) equally a way to pay you back on balances upwardly to $fifteen,000.99. Again, you tin can earn involvement by only using your BankMobile Vibe Up Debit Mastercard® card.

Talking of the BankMobile Vibe Up Debit Mastercard® card, you lot can hands withdraw coin from your business relationship at various ATM points when you demand cash. ATMs are very convenient for getting funds for your everyday use. Recall as well that you can use the ATM card to buy things online or at a physical branch.

To earn the interest mentioned above, y'all should spend at least $300 per argument cycle on your daily signal-of-auction purchases such as groceries, online shopping, gas, and more than using your BankMobile Vibe Up Debit Mastercard® card.

At the end of a statement cycle, BankMobile will look at your qualifying transactions and utilise your boilerplate ledger residuum to determine your earned interest and utilise information technology to your account.

How does the BankMobile savings account work?

As I mentioned somewhere upward, you can open a savings account from BankMobile to grow your money later on opening a checking account. The BankMobile Savings Business relationship comes with cracking features similar to the BankMobile Vibe Up Checking Account, plus the following:

- 0.50% APY2 on balances up to $15,000.00

- $0 monthly service fee.

- $0 in-network ATM fee.

You lot need to notation that you lot have to part with $three.00 at a non-Allpoint® Network ATM or not-Customers Banking company ATM. The ATM possessor may accuse other fees on top. You should employ Allpoint® Network ATMs or Customers Bank ATMs to avoid the fees. The simply challenge is that ATMs may non be available everywhere.

Yous tin also use the debit menu to motility money to an external bank business relationship when you add together it to your mobile money wallet. Yet, other cards such as prepaid cards allow you lot to transfer money directly to bank accounts using mobile money wallets. Yous can transfer from a prepaid balance to a bank account using the routing and account numbers.

What are the various features of a BankMobile account?

Once you open your account, you will be able to savor various features, which include the following.

i) Allpoint® ATMs

The bank allows y'all to withdraw coin from over 55,000 fee-free Allpoint® ATMs worldwide. Therefore, y'all exercise non take to stress yourself well-nigh where you can withdraw money from your account once you travel abroad.

ii) Budgeting

One time you outset using the institution's services, you will get convenient budgeting tools. You will be able to manage finances either from a desktop with Money Meter or from your telephone with SnapShot.

iii) Mobile bank check deposit

Information technology's easy to deposit your checks with your mobile app. Yous only demand to log into your business relationship, take photos using the Mobile Bank check Capture and deposit anywhere. Checks are among the best ways to transfer coin between banks.

One time you write your check, the beneficiary merely needs to have the cheque to their depository financial institution to deposit it in their account. The concerned bank will then facilitate debiting coin from your account and crediting the beneficiary'southward account.

4) On/off feature for your debit card

You can chop-chop secure your card to prevent unauthorized usage when yous lose or misplace it. Think that someone tin apply your card fifty-fifty if they do not have your PIN. They but need your carte number, the expiry appointment, and the CVV to make payments. Therefore, you can use the BankMobile business relationship to switch your Mastercard® debit carte on/off.

v) Pecker payments

Since your BankMobile account operates like any other bank, y'all can make your payments hands anytime, anywhere, and no paper cuts or stamps are required. Also, yous tin can set auto payments then that even if you forget, your payments will still succeed.

That way, you will continue enjoying services all through. Some of the bills you can pay using the platform include h2o, electricity, internet, among other necessities in your life.

How do y'all add money to your BankMobile account?

In that location are various means yous can add money to your business relationship. They include the following.

i) Transfer money from an external bank account

It is possible to transfer money using the routing number and account number of your BankMobile account using another depository financial institution account with ease. Yous only need to log into the other account online and transfer money using either wire transfer or ACH. You can also give others your business relationship details and then that they can send you money.

two) Utilize direct deposit

You can easily enroll for direct deposit from your employer or government benefits agency and receive funds in your account two days earlier than the traditional banks. Y'all merely demand to download the direct eolith form, fill it out and submit information technology to your employer.

3) Reload at the register

You tin can add together funds at various reload centers up to $500 at a fee. You lot need to visit the nearest reload location and take a fee of around $4.95 with you.

4) Deposit a check

Y'all tin can deposit checks online. Remember that is one of the features that I discussed earlier. Online bank check deposit is easy since you only demand to log in to your business relationship and use the check capture characteristic to upload your endorsed check. Afterward the processing is over, the residuum volition brandish in your account.

How to transfer coin from BankMobile Vibe to another depository financial institution

BankMobile allows y'all to receive money from other banks to acme up. The question is, can yous transfer money from the BankMobile vibe to another depository financial institution? The reality is that you can transfer money from your BankMobile Vibe account to other banks using their routing and account numbers.

You tin move funds by wire transfer at a $25 fee. The maximum transfer limit to your external banking concern account is $10,000, while the maximum transfer limit for moving to some other person's bank account is $1,000.

Bottom line

BankMobile is a fiscal institution that offers a mobile cyberbanking app that offers branchless banking services. The company's headquarters is in New York City. It started its operations in 2015 under the leadership of Jay Sidhu and Luvleen Sidhu.

It mainly targets students who can benefit from various features online. In that location are various kinds of transactions that yous can do with your account, such as bill payments, sending coin, and saving money, amongst others.

Source: https://transfermone.com/transfer-money-from-bankmobile-vibe-to-another-bank/

Posted by: brownnepre1992.blogspot.com

0 Response to "How To Add Money To Bankmobile Vibe"

Post a Comment